Have you heard much about interest on reserves during the past couple years? Well I haven't either, but this little discussed topic may be having enormous consequences for financial markets and our economy. To lay out the groundwork for the argument, it is important to begin by looking at the level of bank reserves within the U.S. financial system and their relation to economic growth and inflation. By law, banks are required to maintain a specific portion (10% in the U.S.) of their deposits in excess reserves. This amount is intended to provide enough emergency funding in the case of a liquidity crisis or bank run for the bank to avoid becoming insolvent. Under normal circumstances including the years preceding the Lehman bankruptcy, banks tend to hold minimal, if any, reserves in excess of those required. These circumstances persist because banks earn zero return on reserves and therefore are better off loaning or investing the funds at any rate greater than zero. Following Lehman's bankruptcy in September 2008, the above normal situation changed dramatically, but not for the reasons many believe.

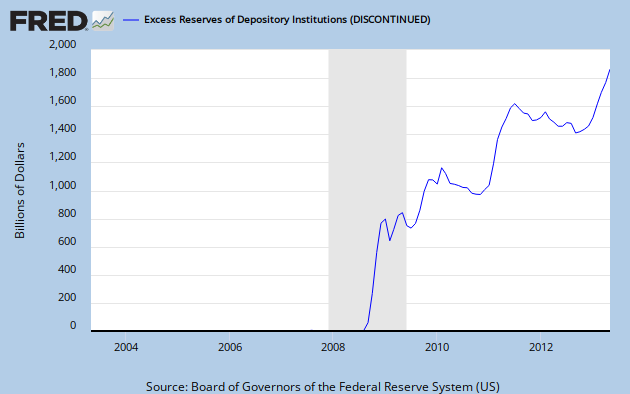

Prior to the Lehman Brother's bankruptcy, required reserves in the U.S. were around $40 billion and excess reserves were a measly $1.5 billion. However, as credit markets seized up in September 2008, excess reserves began growing rapidly as would have been expected. What was generally unexpected though was excess reserves, which initially peaked around $800 billion in January 2009, not only failed to decrease but have increased after credit markets unfroze (shown below). For the past two years, these massive excess reserves have been used to criticize banks for not lending enough. Although there may be many arguments for why such large amounts of excess reserves have been accumulated, one reason above all others was articulated by a couple staff economists working for none other than the New York Fed itself. The report Why Are Banks Holding So Many Excess Reserves?, by Todd Keister and James McAndrews, argues that the Federal Reserve's decision to pay interest on reserves (IOR) is the primary explanation for the accumulation of reserves.

In October 2008, attempting to thaw credit markets, the Federal Reserve for the first time in its history elected to start paying interest on reserves held at banks. As the Federal Reserve began purchasing assets from banks, reserves piled up and confidence in short-term credit facilities returned. For its original intended purpose, paying interest on reserves appeared to work well. However, as the Fed shifted its priorities from opening up credit markets to jump starting the economy, this policy would prove extremely counter productive.

While credit markets began to ease in late 2008, the economy was still mired in a terrible recession and confidence was severely lacking. In March 2009, with the stock market plunging to new lows, the Fed announced a new quantitative easing program including purchases of mortgage-backed securities and Treasuries. At the time, the Fed Funds rate, which determines short-term interest rates, was already anchored near the zero bound. Quantitative easing was therefore designed to increase the money supply, driving longer-term interest rates lower and generating greater spending. Lower interest rates by their nature increase the number of alternative investments that would be more profitable, encouraging banks to ramp up lending practices. Each extra dollar added to the money supply is generally expected to create even further growth in the money supply due to a multiplier effect. This basic premise is that banks will lend the extra funds, which once spent end up as deposits in another bank. That bank will lend the excess reserves, above the minimum requirements, and this process will occur many times over until nearly all excess reserves are removed from the banking system. Quantitative easing is therefore expected to enlarge the money supply beyond its initial scope, generating increased consumption and ultimately higher economic growth and inflation.

The above scenario is what was supposed to happen after QE1 and what is hoped will occur with the establishment of QE2. Unfortunately, if the Fed staff economists are correct (which appears to be the case), the Fed's own policies should be expected to nullify the effects of quantitative easing. As stated in the research report, "if the central bank pays interest on reserves at its target interest rate,..., the money multiplier completely disappears. In this case, banks never face an opportunity cost of holding reserves and, therefore, the multiplier process described above does not even start." To help explain this phenomenon, let's consider the current interest rate environment. The Fed Funds rate is currently being held between 0% and 0.25%, with these rates expected to remain constant for at least a couple years. Based on these rates, Treasury bills and notes ranging from 30-day durations out to a year have generally held within this range. Although these investments are liquid, Treasuries are exposed to interest rate risk. At the same time, the Fed is currently paying interest on reserves equivalent to 0.25% per day and without the same risks. In this real world scenario, the Fed is actually paying interest on reserves above its target rate, affording banks the rare opportunity to earn greater returns with reduced risk. Looking at this scenario, its no wonder why excessive reserves have remained incredibly high and the Fed has been unable to spark inflation.

There are a few other interesting takeaways from this discussion. For one, banks have received much criticism for being too stringent in providing loans and for maintaining such large sums of excess reserves. Upon review, it appears that the decision to maintain massive excess reserves is not only entirely rational, but even encouraged by Fed policy. As for the Fed, one has to question if the Fed will ever stop paying interest on reserves in the future. Doing so with current interest rates would likely spark a quick and enormous increase in the flow of funds throughout the global economy. Although this would likely spur economic growth it could also be expected to unleash painfully high inflation. If the Fed continues paying interest on reserves, future decisions to raise the Fed Funds rate above that paid on reserves may risk creating the same problems. For better or worse, the Fed must now consider a new set of variables when making policy decisions for the foreseeable future.

No comments:

Post a Comment